Dive Brief:

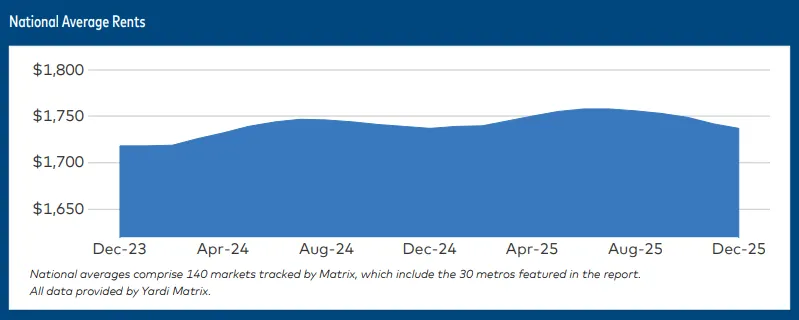

- Rent prices slumped at the end of 2025, wiping out all the gains from the first half of the year, per Yardi Matrix’s national rent report released Wednesday. Still, the Santa Barbara, California-based real estate data firm said demand remains high, and investors are increasing transaction volume and paying up for multifamily properties.

- The average advertised U.S. rent fell $5 to $1,737 in December, down 0.3% from the previous month. Year over year growth dropped 20 basis points to 0%.

- The quarterly picture was even weaker as rents declined $16, or 0.9%, to end 2025. That Q4 performance was the weakest showing since the global financial crisis, raising concerns about near-term multifamily demand, according to the report.

Dive Insight:

Years without rent growth are rare, according to Yardi. The most recent year with no average national advertised rent increase on record was 2020 amid the COVID-19 pandemic, and before that, during the recovery from the global financial crisis in 2010.

Still, rents surged 22% between 2021 and 2022, making some degree of normalization inevitable, according to Yardi.

Single-family build-to-rent advertised rent prices also weakened at the end of 2025, according to Yardi, though occupancy remains strong. The average advertised rent declined by $4 in December to $2,180, while the year-over-year growth rate fell to -1%.

Overall, occupancy has been a “notable bright spot,” remaining firm as more renters stay in place and fewer transition into homeownership. This resilience also reflects owners’ strategy to prioritize retention through lower renewal increases and concessions.

Renter behavior remains bifurcated, though, with lifestyle occupancy up 0.2% year over year while renter-by-necessity occupancy declined 0.2%, reflecting heightened price sensitivity among lower-income renters due to inflation and slowing wage growth.

In addition, regional disparities that defined recent years persisted in 2025: Rent growth remained concentrated in coastal markets and the Midwest, while the weakest performance was mostly in the Sun Belt, where elevated new supply continues to weigh on pricing.

Rent growth was strongest in gateway and Midwestern markets, led by New York (5.8% YOY), Chicago (3.6%), the Twin Cities in Minnesota (3.2%), Kansas City, Missouri (2.6%), and San Francisco (1.9%). Meanwhile, rents fell in many Sun Belt and Western metro areas, with Austin, Texas (-5.2%), Phoenix (-4.1%), Denver (-3.9%), Las Vegas (-2.5%) and Portland, Oregon (-2%), the worst performers.

Although record absorption helped offset new deliveries in the first half of the year, it has since moderated, though it remains healthy by historical standards. At the same time, demand has slowed amid flattening job growth and the impact of immigration policy.

In light of these mixed signals, Yardi expects modest rent increases in 2026, a view echoed by other industry experts.

“Despite ongoing economic uncertainty, stronger GDP growth in the fourth quarter points to improving momentum,” according to Yardi. “Greater stability in 2026 could help lift consumer confidence and support a gradual rebound in rental demand.”

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.