The Latest

-

Top multifamily industry conferences in 2026

Multifamily Dive has apartment pros covered with a full list of upcoming rental housing events, expos and meetings.

Updated Jan. 27, 2026 -

Morgan, CAPREIT, Core Spaces make apartment buys

In a sign that deal volume could be picking up, three major multifamily players announced the acquisition of apartment and student properties this week.

-

Hamilton Zanze expands in Nashville area

City Limits, a 254-unit garden-style apartment community between the Middle Tennessee towns of Columbia and Spring Hill, marks the real estate investment company's third buy in the market.

-

Q&A

How Glavovic Studio leverages adaptive reuse to design affordable homes

Margi Glavovic Nothard believes the Southern Florida affordable housing market is strong. Repurposing older buildings can help make the financials work.

-

Teachers struggle to afford housing. What are districts doing about it?

To help recruit and retain staff, more districts are stepping in to give them a break on rent — and even a leg up on home ownership.

-

New York apartment portfolio, Dallas property head to servicing

The Singer Bronx Multifamily Portfolio was transferred after several months of being delinquent, while Texas’ The Riley participated in the Garland Housing Finance Corporation program.

-

NRP Group breaks ground on Texas school conversion, Arizona community

The Cleveland-based multifamily developer recently started two major housing projects in Austin and Mesa.

-

New bipartisan bill bars major investors from buying single-family homes

Legislation released in the wake of President Donald Trump’s State of the Union address aims to boost homeownership, but experts say it won’t solve the root problem plaguing housing affordability and access.

-

Apartment sales volume fell 25% YOY in January

Prices fell 0.1% year over year, though they have been rising steadily over the past four months, according to an MSCI report.

-

How one company is using AI to transform affordable housing

EliseAI is automating workflows and taking phone calls for property managers who oversee one in six rental units in the U.S., the company says.

-

Deep Dive

Immigration raids are hitting multifamily operators. Here’s how they’re responding.

Managers report negative occupancy impacts from ICE in states like Florida and Texas, which could be the “straw that breaks the camel's back” for class C properties, according to one expert.

-

American Landmark names chief innovation and technology officer

Adam Smolyar will oversee enterprise technology strategy, innovation agenda and digital transformation initiatives for the Sun Belt-focused owner-operator.

-

Lynd Management Group takes over troubled Falls properties in Houston

The multifamily firm will have operational responsibility for 10 assets, in a city that has been plagued by multifamily loan issues.

-

What Trump said about housing in his State of the Union address

The president emphasized affordability in his economy-focused annual speech, but offered little new information.

-

Multifamily delinquencies hit highest level since global financial crisis

Following Q3 2025's high, distress will continue "ticking up and up" due to issues with floating-rate loans as well as rising operating expenses, according to CRED iQ's Mike Haas.

-

Pritzker proposes statewide zoning standards to boost housing in Illinois

Illinois Gov. JB Pritzker targeted local housing regulations in his State of the State this week, unveiling a path for more “missing middle” development.

-

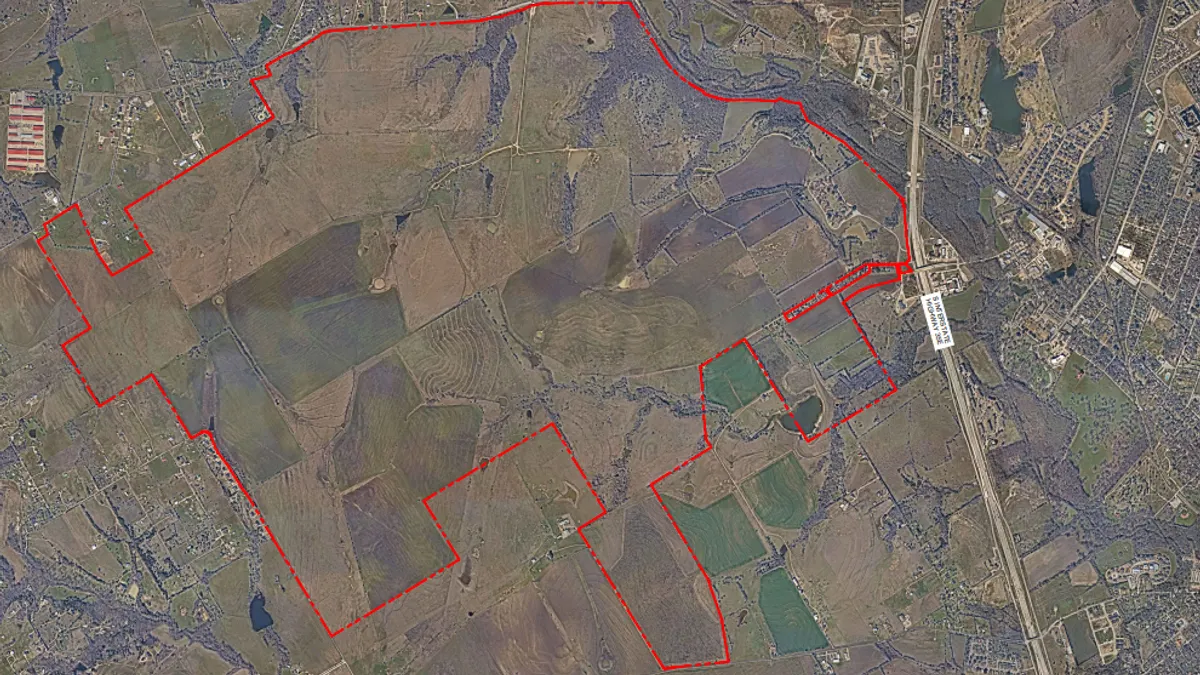

Minto plans mixed-use project with 750 apartments in Dallas area

The sprawling 13,270-home master-planned community in Waxahachie — set to be the largest in the region — marks the developer’s entry into Texas.

-

Retrieved from Fannie Mae.

Retrieved from Fannie Mae.

Fannie Mae sues Houston apartment owner over alleged fake repairs

The lender filed suit last week against Kajal Housing Group for neglecting Bellfort Village Apartments, which was collateral for its $13.2 million loan.

-

Veris Residential sold for $3.4B in all-cash deal

A consortium including Affinius Capital and Vista Hill Partners has agreed to purchase the Northeast-focused multifamily REIT, though another bidder could emerge.

-

What the Supreme Court tariff ruling means for construction

Near-term relief from the 6-3 court decision could be short-lived and counteracted, said Anirban Basu, chief economist at Associated Builders and Contractors.

-

29th Street Capital buys 1,225-unit Washington, DC-area multifamily portfolio

The firm acquired three class A properties in Prince George’s County, Maryland, as it bets on a metro area hit by federal job cuts.

-

Student housing preleasing off to strong start, while rents decline: Yardi

The deceleration in rent growth has been pronounced across major student housing markets, a new 2026–2027 academic year report shows.

-

HUD rule would bar families with mixed immigration status

The proposed policy changes would result in the eviction of tens of thousands of tenants from agency-supported housing, nonprofit groups say.

-

Kennedy Wilson go-private deal draws scrutiny

A consortium led by the company's chairman and CEO, other senior executives and Fairfax Financial Holdings Limited will acquire the real estate investment firm, though one law firm is raising questions about the deal.

-

Multifamily housing starts jumped to highest level of 2025 in December

New apartment construction rose at the end of the year but was still down slightly from the same period in 2024.