Affordable housing typically costs more to build than market-rate in the U.S., and market conditions vary widely even within a given metro area. New research published this month by Yardi Matrix illuminates where it’s most feasible to build affordable housing — that is, where there’s a strong demand for it as well as less competition from market-rate properties.

Many jurisdictions place extra regulatory requirements on affordable housing, such as mandating higher environmental standards and union labor, which drives up costs, per the Santa Barbara, California-based real estate intelligence firm’s report. Affordable developments also have higher soft costs, such as legal and consulting fees, because projects increasingly necessitate developers to layer subsidies and grants.

The issue is an urgent one: A Harvard Joint Center for Housing Studies report found that a record 22.6 million renters in 2023 met the definition of cost-burdened. There are other headwinds contributing to the housing strain on U.S. households, according to Yardi report authors Paul Fiorilla and Jacob Gonzalez.

“Because construction and financing costs have risen in recent years and the value of tax credits has declined, each dollar deployed for affordable housing builds fewer units,” Yardi’s report says.

A federal boost is on the way via President Donald Trump’s tax bill, signed into law this spring. It permanently increases by 12% funding for the Low-Income Housing Tax Credit program — the primary driver of affordable housing construction in the U.S. It also indefinitely extends and updates the 2017 Opportunity Zone program, which provides tax incentives to build housing in low-income areas, per Brookings.

To ensure that public dollars are spent wisely and serve their intended purpose, affordable housing developers should analyze every relevant factor, including the competitiveness of the submarkets in which they build, according to report authors.

Where is it best to build affordable housing?

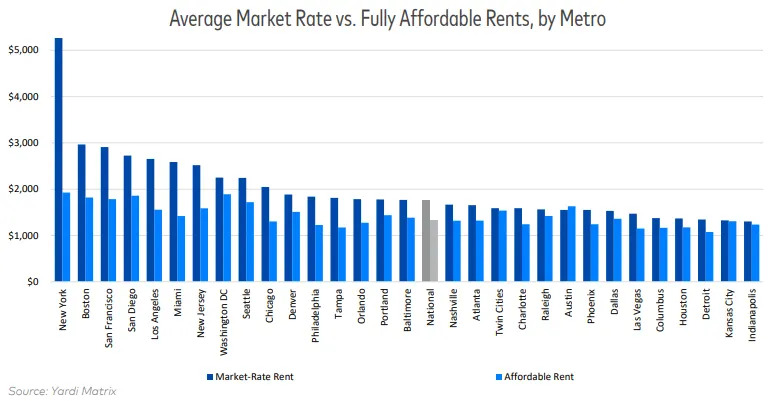

One way to efficiently build affordable housing is to use data to ensure that projects are delivered to locations with both strong demand and less competition from market-rate properties. To suss that out, the report authors compared rents between market-rate and fully affordable housing units in Yardi Matrix’s national database of 120,000 multifamily properties.

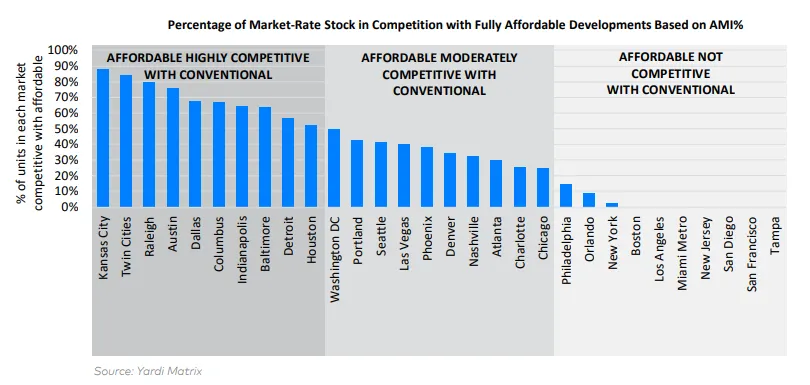

Yardi’s research found that in some metros, a large percentage of market-rate properties’ advertised rents are competitive with fully affordable properties’ rents, while in others, there is very little competition between the two. For example, in Philadelphia, New York City and Orlando, Florida, there is little competition between affordable and market-rate properties, while in Houston, Detroit and Baltimore, they are highly competitive with each other.

A key factor influencing competitiveness is the absolute level of market rents: In metros where average advertised rents exceed $2,500, market-rate properties rarely compete with affordable housing.

Other correlations are the amount of supply growth as well as the age of multifamily stock within a metro. Overall, the more new supply, the more competitive affordable housing is with market-rate options. Age matters, though: New construction is concentrated in higher-end segments, so metros with a larger percentage of apartment stock built over the past decade or two usually have a higher proportion of luxury, market-rate apartments that are not competitive with affordable units.

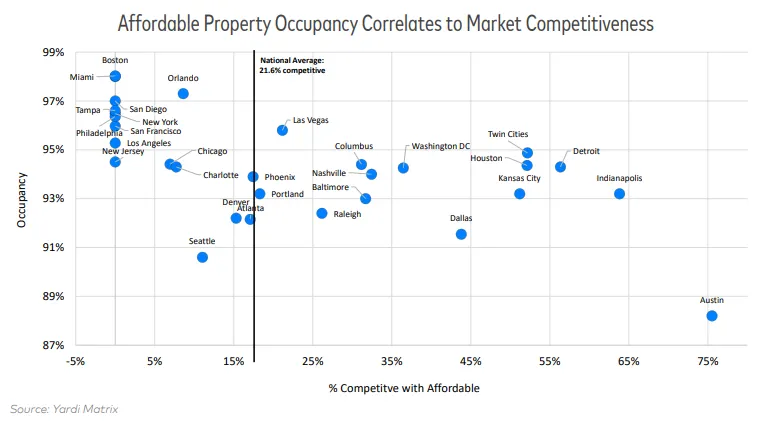

Relatedly, occupancy rates of fully affordable properties are generally higher in metros where market-rate rents are less competitive with affordable rents, the authors found.

That’s because market-rate properties that are competitive with affordable properties serve overlapping income groups and may compete for the same tenants. A rule of thumb is that renters are more likely to choose to live in a market-rate property if rents are within 10% of affordable housing rents, according to the report.

There is also wide variation within a given metro, the report authors found. The level of competitiveness varies greatly from submarket to submarket depending on factors like the cost of market-rate rents, supply, the age of the multifamily stock and the income of residents.

“Competitiveness between market rate and fully affordable properties is not consistent within metros. That makes it incumbent on affordable housing developers to underwrite submarkets where they plan to build,” Yardi authors wrote.