Affordable housing developers are staring down a variety of challenges going into 2026, but they also have reasons for optimism, according to Santa Barbara, California-based real estate intelligence firm Yardi Matrix.

The country has a persisting shortage of affordable housing that has built up over time, due to zoning restrictions, slow permitting and the myriad requirements that drive up costs, said Jeff Adler, vice president of Yardi Matrix, in a Nov. 13 webinar about the affordable housing outlook.

“The problem is, even with the best of intentions, if you add to complexity, you end up adding to cost, and because you add to the cost, you add to the time and you end up not being able to do what you intended to do,” Adler said.

At the same time, new policies aim to improve the situation, and developers can also target profitable submarkets to maximize returns on their investments. Read on to explore the factors that Yardi found are shaping the affordable housing landscape into the new year.

Economy

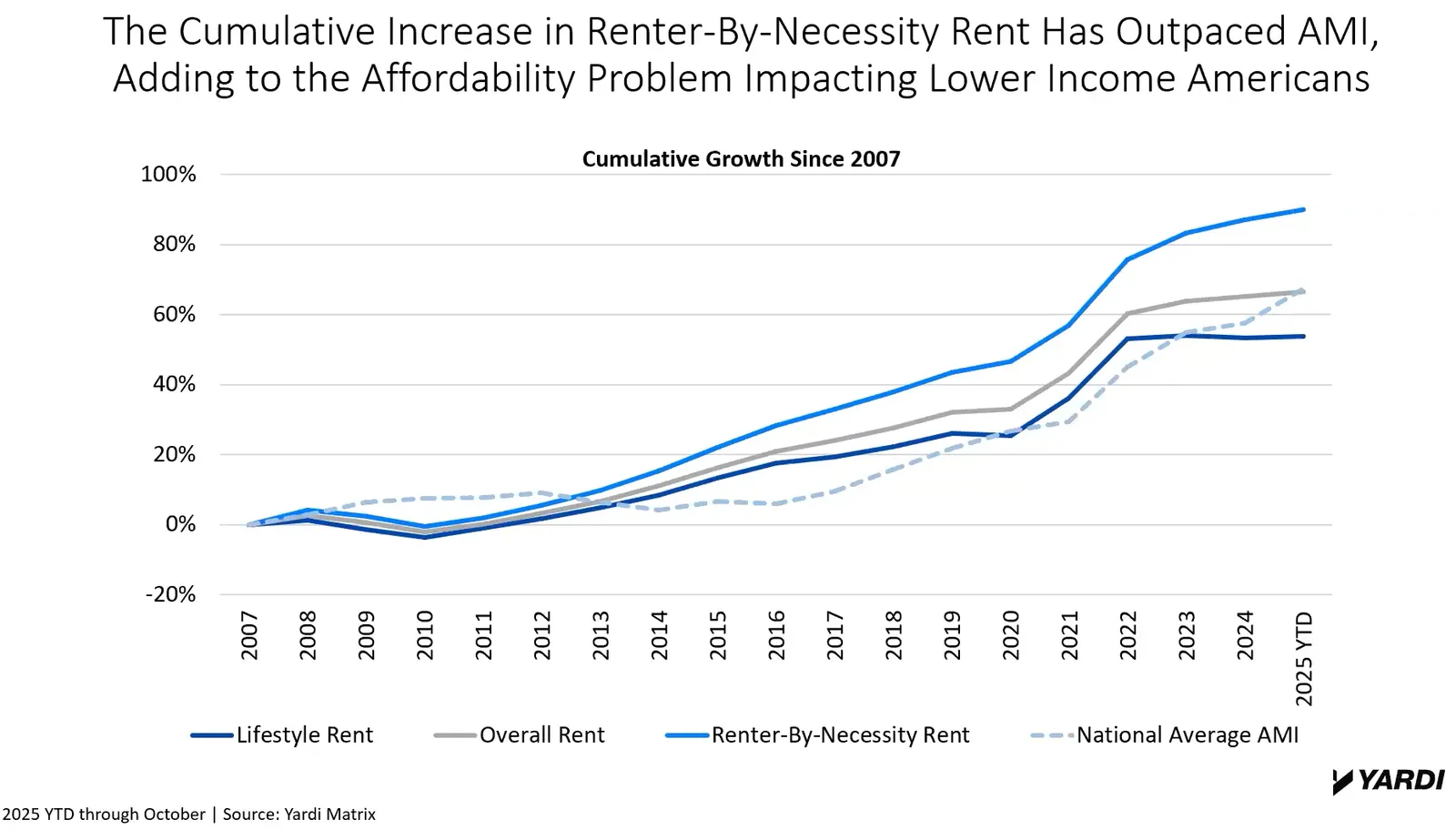

The economy is stagnating overall, and recent spending has been bolstered by the top 10% of households. There are concerns about low-income renters’ financial health as rent prices rise higher than incomes, according to Adler.

“Lower-income households are under stress, there’s no question about that,” Adler said. “Lower-income Americans are definitely feeling the pinch in rent, and it is showing up in collections issues in many places.”

Although job growth is anemic, there are bright spots: Deregulation, lower energy costs and tax cuts are set to counteract trade and labor cost pressures, Adler said. The Trump administration’s new fiscal policy mix is emerging, although it likely won’t be in place fully until mid-2026. In the meantime, artificial intelligence could help juice the economy.

“It does appear somewhat hopeful that AI could drive productivity enough to be the supply shock that keeps things kind of afloat until growth reignites. And I believe that’ll happen mid-year 2026,” Adler said.

Operating expenses have also been growing, but Yardi found that NOI has still been positive this year despite the hike.

Policy

In a rare bipartisan gesture, a major housing bill passed the Senate in October. The ROAD to Housing Act directs HUD to develop best practices that equip state and local governments with an array of options to increase housing production.

That’s a positive sign, Adler said, but “there are lots of little funding gaps because of the increase in costs and regulatory challenges.”

More changes are happening at the state and local level. In June, California passed legislation that streamlines its environmental review process with the goal of speeding up new construction, and earlier this month, New York City passed several ballot measures aimed at boosting affordable housing.

At the same time, Los Angeles recently limited rent increases, Politico reported, which Adler thinks will worsen the shortage.

Location, location, location

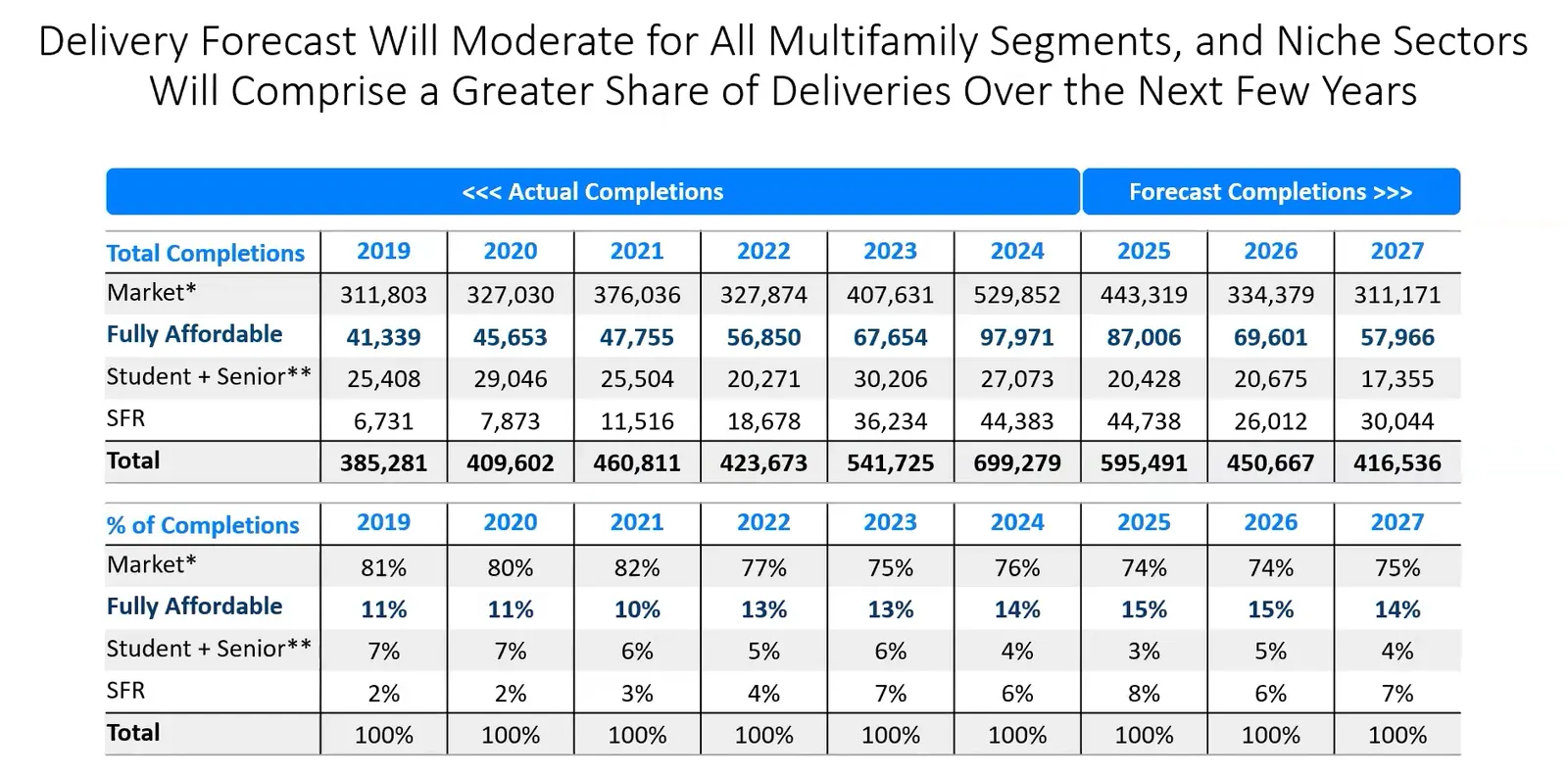

Although more affordable housing is set to come online, there’s less in the pipeline than last year. Multifamily and affordable housing completions peaked in 2024, and Yardi expects it to decline into 2027 and then level out.

“It certainly seems to me that when the supply surge passes this year and recedes in ‘26 and ‘27, that we still have a significant housing shortage that has not been resolved,” Adler said. “Fundamentally, we’re just not building enough.”

In certain markets, affordable housing has to compete with conventional multifamily. When that happens, affordable owners do not achieve maximum net rents and must differentiate their offerings based on quality, recent Yardi research shows.

That’s why it’s critical to pinpoint favorable submarkets, even down to the bedroom level, for affordable development, per Yardi’s Director of Research Paul Fiorilla, who contributed to the report.

“The lesson is, is that it’s just not enough to know the big market, you have to know the specific, most granular area if you want to have a successful development,” Fiorilla said in the webinar.

Investment strategies

Underwriting for affordable housing remains complicated, as developers have to layer multiple subsidies and tax credits to make these developments pencil out, Fiorilla said. That complexity adds significant cost and stretches construction timelines.

Consolidating the hundreds of federal housing programs would ease compliance costs and likely result in higher production.

In addition, large employers such as hospitals, municipalities, universities and theme parks like Disney are also increasingly building affordable housing for their workers.

Beyond new construction, there are other mechanisms for creating affordable housing that are gaining traction, such as renovation — where developers buy an asset near the end of a compliance period and use tax credits to overhaul it — as well as preservation of existing affordable housing, Adler noted.

As the federal Low-Income Housing Tax Credit program ages, more of those units are coming toward the end of their extended use period, and “that provides an opportunity to recapitalize these projects,” Adler said. “There’s definitely a preservation need.”

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.