Transactions

-

Arbor ‘being very aggressive’ with distressed apartment sales

The multifamily lender believes the cycle has bottomed out, with a clear path to resolving most of its distressed loans. Immigration enforcement, however, has added to its problems.

By Leslie Shaver • March 6, 2026 -

Opinion

What’s the most effective way to reduce risk in multifamily investing in 2026?

Amid modest rent growth and harder-to-predict costs, disciplined execution and downside protection are key, according to Finquity Capital’s Emanuel Gana and Alice Villar.

By Emanuel Gana and Alice Villar • March 5, 2026 -

Q&A

Why Jason Amoroso believes in the California rental market

While some major multifamily players look to exit the state, the family firm sees high for-sale prices sustaining rental demand as it partners with Arselle Investments.

By Leslie Shaver • March 5, 2026 -

Morgan, CAPREIT, Core Spaces make apartment buys

In a sign that deal volume could be picking up, three major multifamily players announced the acquisition of apartment and student properties this week.

By Leslie Shaver • March 4, 2026 -

Hamilton Zanze expands in Nashville area

City Limits, a 254-unit garden-style apartment community between the Middle Tennessee towns of Columbia and Spring Hill, marks the real estate investment company's third buy in the market.

By Leslie Shaver • March 3, 2026 -

New York apartment portfolio, Dallas property head to servicing

The Singer Bronx Multifamily Portfolio was transferred after several months of being delinquent, while Texas’ The Riley participated in the Garland Housing Finance Corporation program.

By Leslie Shaver • March 2, 2026 -

Apartment sales volume fell 25% YOY in January

Prices fell 0.1% year over year, though they have been rising steadily over the past four months, according to an MSCI report.

By Leslie Shaver • Feb. 27, 2026 -

Lynd Management Group takes over troubled Falls properties in Houston

The multifamily firm will have operational responsibility for 10 assets, in a city that has been plagued by multifamily loan issues.

By Leslie Shaver • Feb. 26, 2026 -

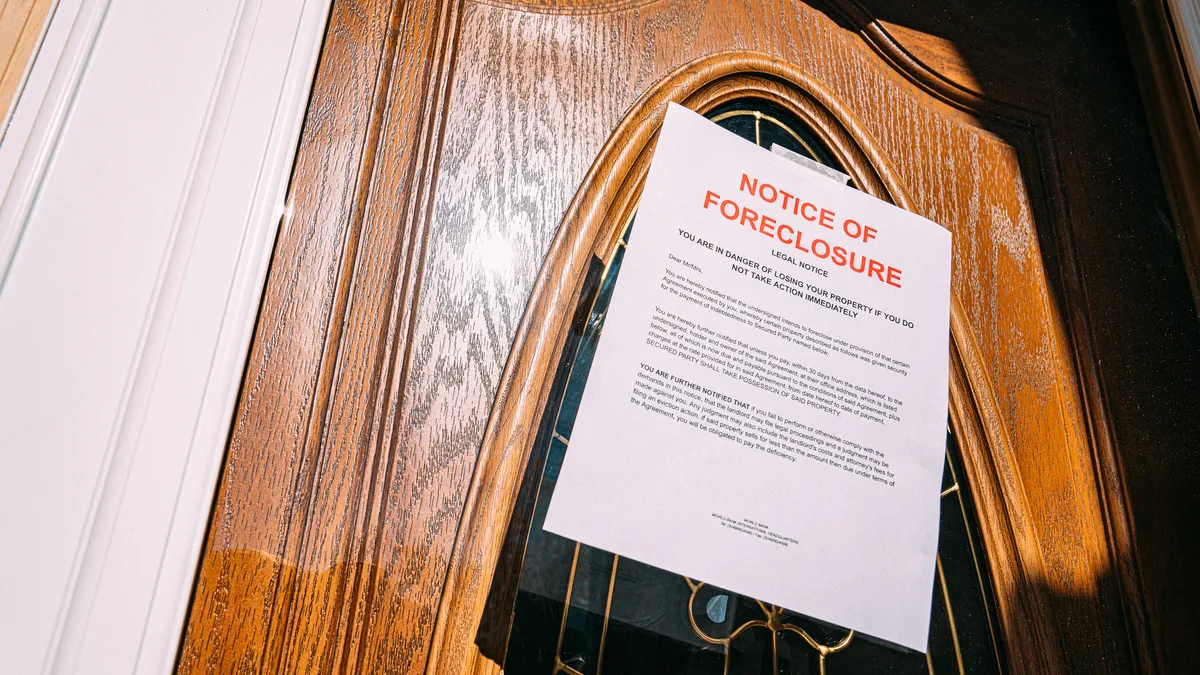

Multifamily delinquencies hit highest level since global financial crisis

Following Q3 2025's high, distress will continue "ticking up and up" due to issues with floating-rate loans as well as rising operating expenses, according to CRED iQ's Mike Haas.

By Leslie Shaver • Feb. 25, 2026 -

Veris Residential sold for $3.4B in all-cash deal

A consortium including Affinius Capital and Vista Hill Partners has agreed to purchase the Northeast-focused multifamily REIT, though another bidder could emerge.

By Leslie Shaver • Feb. 23, 2026 -

29th Street Capital buys 1,225-unit Washington, DC-area multifamily portfolio

The firm acquired three class A properties in Prince George’s County, Maryland, as it bets on a metro area hit by federal job cuts.

By Leslie Shaver • Feb. 20, 2026 -

Kennedy Wilson go-private deal draws scrutiny

A consortium led by the company's chairman and CEO, other senior executives and Fairfax Financial Holdings Limited will acquire the real estate investment firm, though one law firm is raising questions about the deal.

By Leslie Shaver • Feb. 19, 2026 -

Centerspace CEO says ‘a little early’ to tell if strategic review will change REIT’s 2026 strategy

The Minneapolis-based multifamily firm saw net operating income grow 3.5% year over year, driven by 2.4% revenue growth in 2025.

By Leslie Shaver • Feb. 18, 2026 -

Apartment REITs face uncertainty in 2026

Income will still be challenging for multifamily's biggest public companies, as Camden and UDR plan major sales.

By Leslie Shaver • Feb. 13, 2026 -

UDR expects to be a net seller in 2026

The REIT’s early 2025 lease-expiration management strategy helped it weather Q4 and set it up for 1.5% to 2% blended lease rate growth in 2026.

By Leslie Shaver • Feb. 12, 2026 -

CRE servicers ‘increasingly aggressive’ toward distressed assets: CRED iQ

The data firm projects the overall distress rate could reach 15% by December 2026, while Trepp noted an increase in multifamily servicing and delinquency rates in January.

By Leslie Shaver • Feb. 11, 2026 -

Camden looks to double down on the Sun Belt

The REIT expects rental conditions to improve in the region, as apartment supply is absorbed throughout 2026.

By Leslie Shaver • Feb. 9, 2026 -

Activist investor pushes Veris to sell itself

In a letter, Goldman Sachs and Cedars alum Bruce Schanzer said the REIT’s apartment properties trade at a discount to net asset value of over 30%.

By Leslie Shaver • Feb. 6, 2026 -

MAA says concessions in the 5-week range on Q4 earnings call

The REIT’s executives think declining supply and continued strong demand will provide a boost as 2026 progresses.

By Leslie Shaver • Feb. 5, 2026 -

5 notable multifamily funds raised in recent months

Heitman and American Landmark are among the major investors building large chests for acquisition sprees.

By Leslie Shaver • Feb. 5, 2026 -

American Landmark boosts capital markets teams as it eyes $1B in equity funding

Andrew Yam and Jessica Wichser will be based in New York to deepen the firm’s relationship with institutional investors.

By Leslie Shaver • Feb. 4, 2026 -

Q&A

How Ballast plans to turn around San Francisco’s beleaguered Parkmerced complex

CEO Greg MacDonald says he remains focused on the day-to-day as he works to overcome challenges at the mammoth property.

By Leslie Shaver • Feb. 3, 2026 -

3 multifamily properties that went into servicing in January

Two 2024-vintage Freddie Mac loans in Colorado and one Houston property were transferred.

By Leslie Shaver • Feb. 2, 2026 -

Where one investor sees distressed apartment opportunities

Neighborhood Ventures is launching a second opportunistic $25 million fund to acquire troubled multifamily properties.

By Leslie Shaver • Jan. 29, 2026 -

Federal Reserve holds rates steady

Multifamily leaders anticipated a limited impact from the announcement, though they still expect rate cuts later in the year.

By Leslie Shaver • Jan. 28, 2026