Dive Brief:

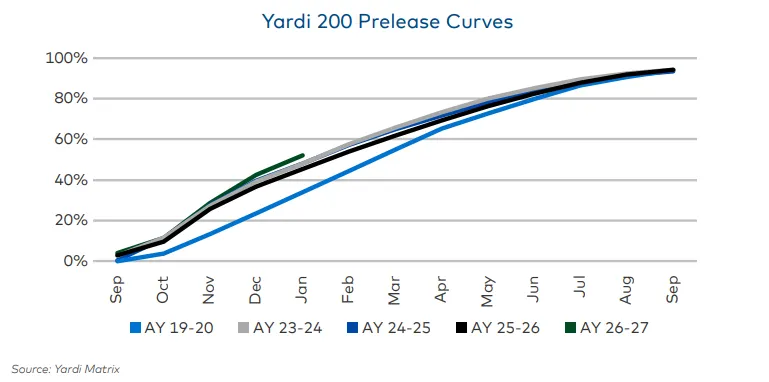

- The student housing rental season for the 2026-2027 academic year is off to a solid start, early data analyzed by Yardi indicates. Its report, released Wednesday, shows preleasing for the Yardi 200 schools reached 52.3% in January, up nearly 15% from about 45.6% in January 2025.

- Although a majority of Yardi 200 schools are pacing ahead of last year, performance varies widely by market and remains closely tied to recent and upcoming supply, per the Santa Barbara, California-based real estate analytics firm.

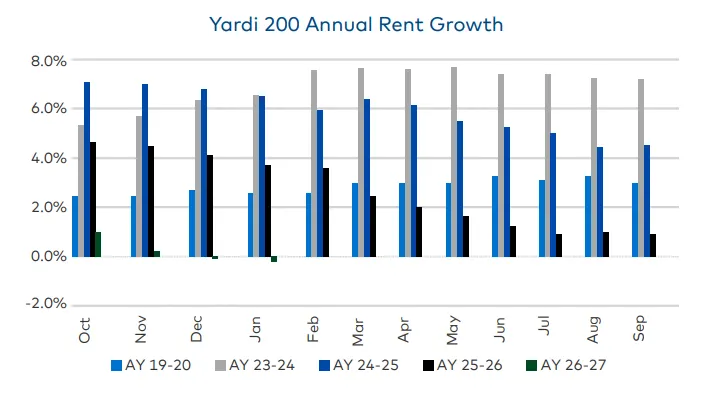

- Rent growth has continued to decelerate sharply, and average rent per bed ticked down year over year in January. That deceleration has been notable across major student housing markets, and rent prices are slumping in many areas this year.

Dive Insight:

Last year, some student housing companies were impacted by the Trump administration’s immigration policies, which muted international student enrollment. Yardi collected fall 2025 total enrollment data for 184 of the Yardi 200 universities that counted 4.9 million students, up 1.8% year over year versus 2.1% growth in fall 2024.

“The largest enrollment gains were recorded at Kentucky, Texas State, Kennesaw State and

Illinois, while 54 schools saw enrollment declines, led primarily by private institutions and tertiary state schools in the Midwest and West,” according to Yardi.

So far, student leasing activity appears to be pacing comparably to the 2025-2026 academic year: In January, 64 schools, including the Georgia Institute of Technology, the University of Illinois, the Virginia Polytechnic Institute and State University and Auburn University, were ahead by 10% or more compared to last season.

On the other hand, 28 schools were more than 10% behind last year, including Purdue, Indiana University and the University of Tennessee, all of which have absorbed significant new supply in recent years and have more deliveries on the horizon.

Rent performance also varies by school, though far fewer markets are posting strong growth compared to last year.

Rent growth has continued the long-term pattern of slowing that started in fall 2023, and rents per bed across the Yardi 200 averaged $915 and have remained flat since the start of the leasing season in October 2025.

Overall student housing rent prices fell 0.2% YOY in January, compared to 3.7% YOY growth in January 2025 and 6.5% growth in January 2023 and 2024.

Nearly half of Yardi 200 markets reported year-over-year rent declines in January averaging -4.6%, while markets posting rent increases averaged 3.7% growth. Although 51 schools have seen rent growth accelerate this year, 135 schools reported lower rent growth compared to January 2025.

In the latest report, Yardi adjusted the batch of schools it analyzes to better align its coverage with the largest concentrations of off-campus student housing. The Yardi 200 now includes nine new universities with 12,816 completed beds — replacing nine with 5,000 beds — for a total count of just over 1 million.

Newly added schools include Indiana University of Pennsylvania, Jacksonville State, Morgan State, Rice University, Tennessee Tech, Troy University, the University of Alabama–Huntsville, the University of Tampa and the University of Tennessee at Chattanooga.

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.