Apartment demand and rent growth have cooled in recent months amid a mixed U.S. economic performance, per a Nov. 12 report from real estate data firm Yardi Matrix. Multifamily rents declined 0.2% in October — the third consecutive monthly decrease and the third straight October with a similar drop.

The average U.S. advertised rent fell $4 to $1,743 during the month, while year-over-year growth was unchanged at 0.5%. Rents have fallen $9 since July, reversing the steady gains seen earlier in the year, and weak multifamily growth looks to persist for another couple of quarters.

Consumer sentiment has also dropped for three consecutive months, reflecting the growing impact of inflation on household finances, and the strain is increasingly evident in spending behavior, report authors noted. The slowdown has prompted operators in high-supply markets to increase concessions and take other steps to attract and retain tenants.

“Property owners are feeling the downward trend, prompting operators in some high-supply markets to take action to retain tenants. Anecdotes abound about properties offering a month or two of free rent on renewals, a concession that typically applies only to new leases,” per the report.

Labor market weakness is also weighing on multifamily demand. Major employers such as Amazon have recently announced layoffs, and unemployment among recent college graduates — a key renter demographic — has climbed to a nine-year high, according to the Bureau of Labor Statistics.

“The pullback highlights the effects of deteriorating consumer confidence, persistent inflation and labor market weakness — signs that the sector may be entering a period of softness,” Yardi report authors wrote. “With price pressures persisting, more renters may be forced to double up or move back home.”

Major policy changes are pulling in opposite directions and creating uncertainty for the industry, according to Yardi.

“Headwinds include tariffs and deglobalization that are increasing costs and injecting uncertainty for companies looking to expand, cuts to industries such as health care and green energy, and the weak labor market,” the authors wrote. “There are tailwinds as well, fueled by deregulation, wealth created by rising stock prices and the rapid adoption of artificial intelligence, which holds the promise of boosting productivity growth.”

Regional trends

Federal worker buyouts have led to roughly 100,000 worker departures, with more expected by year-end, pressuring markets with large government workforces such as Washington, D.C., per the report. Heads of major REITs also noted shutdown- and layoff-related impacts in the region during recent earnings calls.

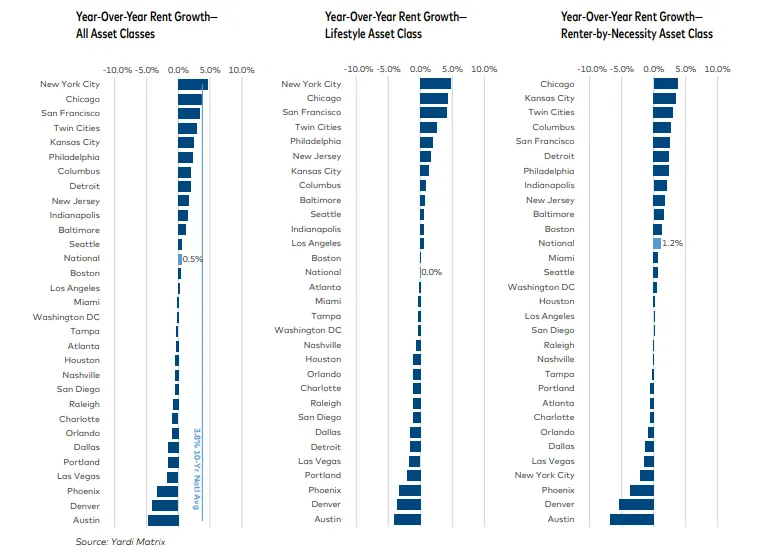

Year over year rent growth was strongest in gateway and Midwest markets, led by New York (4.7%), Chicago (3.9%), San Francisco (3.4%), the Twin Cities (2.9%) and Kansas City, Missouri (2.4%).

Advertised YOY rent growth was negative in many Sun Belt and Western metros, such as Austin, Texas (-4.8%), Denver (-4.1%), Phoenix (-3.3%), Las Vegas (-1.7%) and Portland, Oregon (-1.6%).

On a monthly basis, New Jersey and Detroit were the only metros where rents increased, bumping up 0.1%. Monthly declines were most pronounced in New York (-1.7%), Austin (-1.0%) as well as Raleigh, North Carolina, and Denver (both -0.8%)

The national occupancy rate fell slightly to 94.7% in September but is 0.1% higher than the same period last year.

Absorption rates dropped sharply in recent months in Midwest metros such as Detroit, the Twin Cities and Indianapolis, as well as Sun Belt markets like Orlando, Florida; Nashville, Tennessee; Miami; Southwest Florida; and Dallas.

Still, “it would be jumping the gun to read too much into one quarter of data, especially since regions with short-term weakness have performed well,” per the report.

For example, demand is slowing in the Midwest but supply growth there has also been weak. Plus, starts have fallen by nearly half since 2023, giving high-supply Sun Belt and Western markets time to absorb units in lease-up, an adjustment period likely to last until growth returns.