As part of the ongoing expansion of its operations, Indianapolis-based real estate developer Thompson Thrift is realigning its multifamily development division into three separate teams, each one representing one of its major development regions.

With this new reach, Thompson Thrift aims to launch at least 15 new apartment developments in high-growth markets each year. “This expansion reflects the strength, growth and momentum of our residential team,” said Josh Purvis, managing partner for Thompson Thrift Residential, in the company’s news release.

Bo Chapman, previously a managing director at Charleston, South Carolina-based multifamily giant Greystar, is returning to Thompson Thrift to lead the Central Region team, which includes Colorado and Texas, as senior vice president of development. Here, Chapman speaks with Multifamily Dive about his career, Thompson Thrift’s future development plans and the use of technology in its operations.

This interview has been edited for brevity and clarity.

MULTIFAMILY DIVE: How will your previous experience inform your new role?

BO CHAPMAN: This opportunity feels like a natural evolution of my career. At Greystar, I had the unique experience of building out a region from scratch, and that process taught me a lot about how to stand up a fully integrated development platform and align it with both national strategy and local nuance.

I'm excited to apply the same here, especially as we build out a comprehensive office presence in Colorado with representation across all of Thompson's business units.

I also bring more than a decade of development experience specific to the Colorado market. So, I know the landscape, entitlement hurdles, the regional construction dynamics and, probably most importantly, the relationships that drive success here. So, combining that local insight with the legacy and capabilities of Thompson Thrift is really a tremendous advantage.

Where do you intend to focus your development efforts?

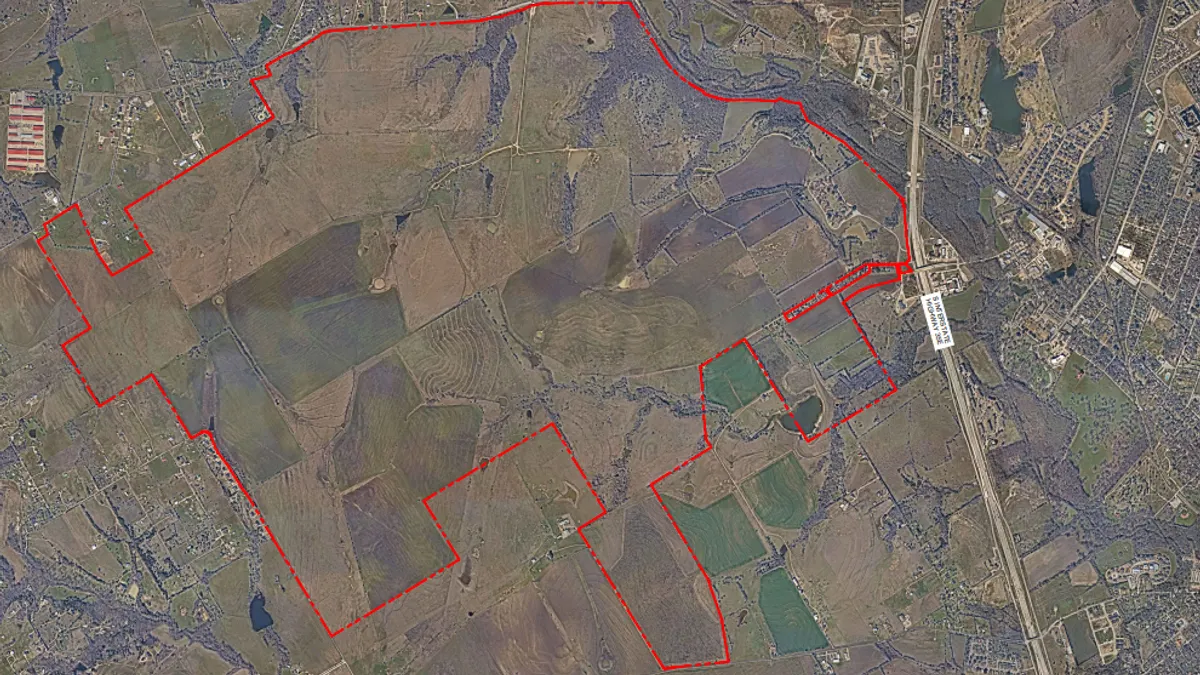

Geographically, our efforts will center in the Denver MSA but reach as far north as Fort Collins and as far south as Colorado Springs. For Texas endeavors, we will likely start by focusing on the DFW, Houston and Austin markets. These are places where we see strong demand and where our product type and approach to community development are, in my opinion, particularly well suited.

Why is Colorado a strong market for Thompson Thrift?

Colorado is a market that we know very well, and one where we have a longstanding presence and track record. The fundamentals remain strong. It has consistent job growth, population growth and positive debt migration trends, which I think are primarily driven by the quality of life. It also helps that the Denver International Airport provides direct access to most major cities across the country, which supports economic activity and mobility.

But what really sets us apart is the strength of our local relationships. Our ability to repeatedly execute here is based on the trust and relationships that our team members have with trade partners, consultants, brokers and even the local municipalities. So, that relationship capital is extraordinary, one of the key reasons that the firm continues to invest here.

What are some of Thompson Thrift’s recent or upcoming projects?

Our activity in Colorado is incredibly strong. We've recently completed five communities. We have another four communities under construction and are in various planning stages on another seven here in the state. So, the total is about 5,000 units of opportunity for us.

Are you making use of any new technologies in your development practice?

I think tech will be one of the biggest discerning factors in our success in the next real estate cycle. I've been thoroughly impressed at how well firms leverage tech to improve how development is executed and managed, day to day. Teams are using intelligent design tools, efficient project management systems and other platforms that I think improve the resident experience.

What are some of the challenges you anticipate and how do you plan to overcome them?

We're navigating a dynamic environment, and we're not immune to the same issues that the rest of the industry faces, but one of our many advantages is that we're a fully integrated real estate firm, that we will self perform construction and self manage our communities. All that allows us to stay on top of the market.

And from a pipeline and sourcing perspective, we stay focused on fundamentals, leveraging data, staying disciplined about site selection and our underwriting criteria. But ultimately, we're here to create long-term value and positively impact the business we serve, and that keeps us grounded even when the path gets tough.