Southern Land Company is betting big on the Las Vegas and New York City suburban markets as it continues to expand its footprint in the luxury multifamily housing space. To help lead its ambitious plans, the company last month tapped Lisa McDonnell as its senior vice president, head of multifamily property management.

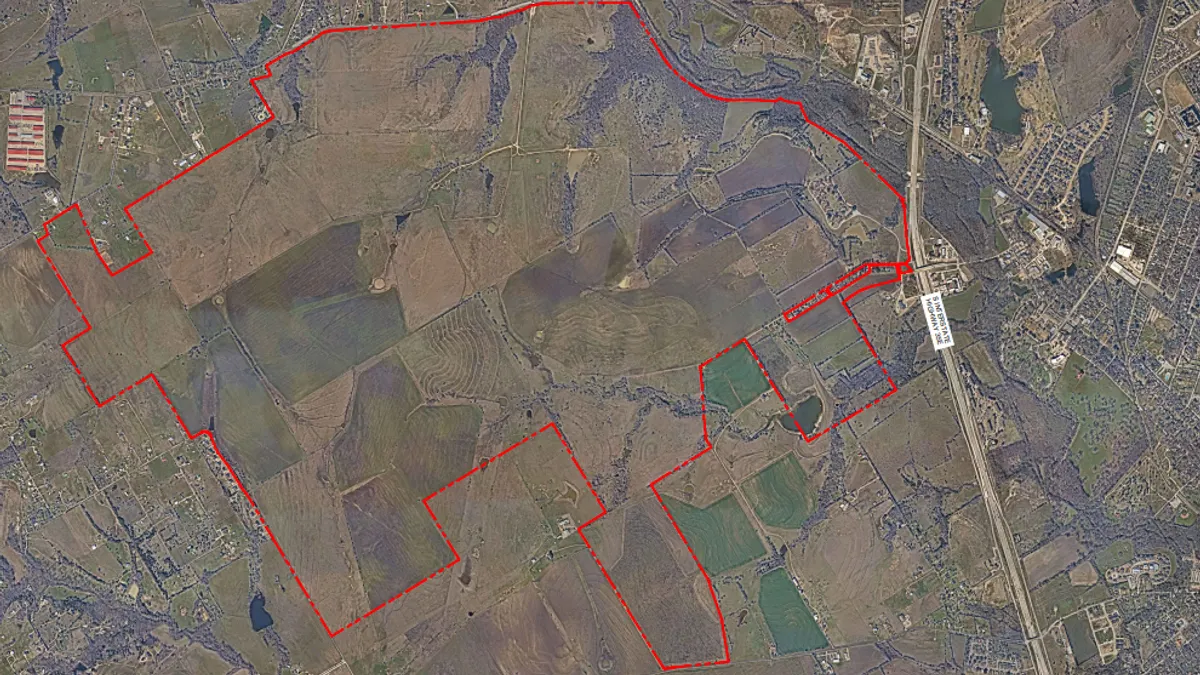

The Nashville-based real estate developer plans to open three new luxury multifamily rental communities totaling nearly 900 units in Las Vegas this spring, including a 22-story high-rise with 272 units and 16,000 square feet of commercial space. Once complete, Capella, in the city’s Symphony Park district, will become the first all-rental high-rise community in Vegas, according to the firm.

SLC also plans to open a 177-unit luxury rental community in downtown White Plains, New York, this year following the success of two new communities that the company opened in Long Island in 2024 and 2025.

In total, SLC has 10 active mixed-use and multifamily communities in its portfolio in Las Vegas; New York; Nashville, Tennessee; Fort Worth, Texas; Philadelphia, Pennsylvania; Colorado; and Charleston, South Carolina. The company plans to significantly expand that number in the near future, with eight communities currently in different phases of development and construction.

For nearly 40 years, SLC has enjoyed widespread success in single-family housing. But now, with McDonnell’s leadership, it’s trying to become a major name in the multifamily space.

“Coming in with a lot of multifamily experience and fresh to this company, I would say everything we do is very high touch, and highly intentional, and curated," said McDonnell. “We’re in that process of really getting the name out there of who we are.”

McDonnell started her career in hospitality before switching to real estate. She’s since moved up the ladder from administrative roles at Nolan Real Estate in Tempe, Arizona, to corporate support at JLB Partners in Dallas, and eventually into leadership positions at Texas-based national management companies, the latest being Cushman & Wakefield.

Here, McDonnell talks about the firm’s expansion plans, career challenges she’s overcome and her outlook for the industry.

This interview has been edited for brevity and clarity.

MULTIFAMILY DIVE: What is it about the Las Vegas and New York markets that prompted SLC to invest, and what does the company look for when evaluating different markets?

LISA MCDONNELL: As the city's cultural district, [Las Vegas’ Symphony Park] is really becoming a premier destination for luxury living, arts and entertainment.

Over the years, if you were to speak to our founder and CEO, Tim Downey, he and his wife would travel to Las Vegas for personal trips, and really enjoyed it and felt like there was a need for high-end luxury rental communities.

As far as how we identify good locations to develop, typically, SLC is looking to develop in top national high-barrier-to-entry markets. We often hear Tim say around here, ‘we build in places where people really want to live,’ and so we prioritize markets that have high walkability and access to mass transit and employment.

What makes the Southern Land unique in the multifamily space?

We are vertically integrated, and we are a best-in-class developer, and so we have some of the most impressive real estate in markets that are highly sought after. And then we have all those key resources in-house, from development design, asset management, property management, and marketing, which allows us to have full control of our execution.

Also, we place an emphasis on having hospitality at the forefront. When I talk to our teams, I always say, ‘we are not a property management company that provides hospitality, but we are a hospitality company that provides property management.’ And that distinction is very intentional.

How has your background grounded you in your approach to the job?

Early in my career, I worked for a small luxury boutique developer, and I joined them at a time when they were transitioning management in-house for a third party. So I was a part of building out their platform and process, which, similar to SLC, was a very fast-paced lease-up development environment, vertically integrated.

We were also actively trying to bring resident experience to life at a time when the interest in that was really just budding. So I bring that experience of getting to build out a platform in a startup for a luxury developer.

Then for the past 10 years, I had the pleasure of working with over 60 client groups, and that spanned many different markets. I had the entire Southwest — so Austin, Texas; Dallas; Houston; Fayetteville, North Carolina; Little Rock, Arkansas into Phoenix.

Getting to work through various market conditions, operational challenges and investment strategies of different client groups positions me really well to guide SLC in this next chapter. I have a broad view that I can figure out how to tailor to the needs of SLC as we look to create structure and think about taking the company into its next phase of evolution.

What challenges have you faced throughout your career in the multifamily space?

I've had a very fast-paced growth trajectory in multifamily. So it often felt like as I was mastering one role, I was stepping into a new one with more responsibility.

I think our industry as a whole has had heavy evolution over the span of the past 15 years. Whether it was technology coming at us at a rapid pace, navigating [COVID-19] response and related challenges, the high supply we've experienced — especially in some of the Sun Belt markets I was in, it was kind of an amenities arms race at the time. The pace was a challenge, because sometimes it doesn't allow you to have the intention that you want to give each stage. But I would say with that pace, that is where you get refined as a leader.

Secondarily to that, I would say leading as a young woman in the industry, there's impact to that. At 35 years old, I was leading the largest market for the third-largest third-party property management company in the country.

When you are young in senior roles, you often are navigating some perceptions around your experience, your credibility. I also worked in a lot of new construction and development environments. I was typically working on class A lease-ups, and so that presented challenges as well. It's a very male-dominated environment.

But going through that, you learn quickly how to build trust, leading with humility, really proving yourself through delivering results and building relationships. I think working with construction, it's an interesting dynamic, but you hone skills about how to toughen your edges, how to assert your voice, when to push back.

Nationally, how do you foresee the multifamily market playing out over the next couple of years?

I think we're all still working through some short-term supply pressure. Completions started to taper off in 2025. We had kind of our 40 year high of deliveries in 2024, and this year we are still working through that. But we expect to hopefully see an upturn in rent and performance and occupancy headed into 2027 and beyond.

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.