Dive Brief:

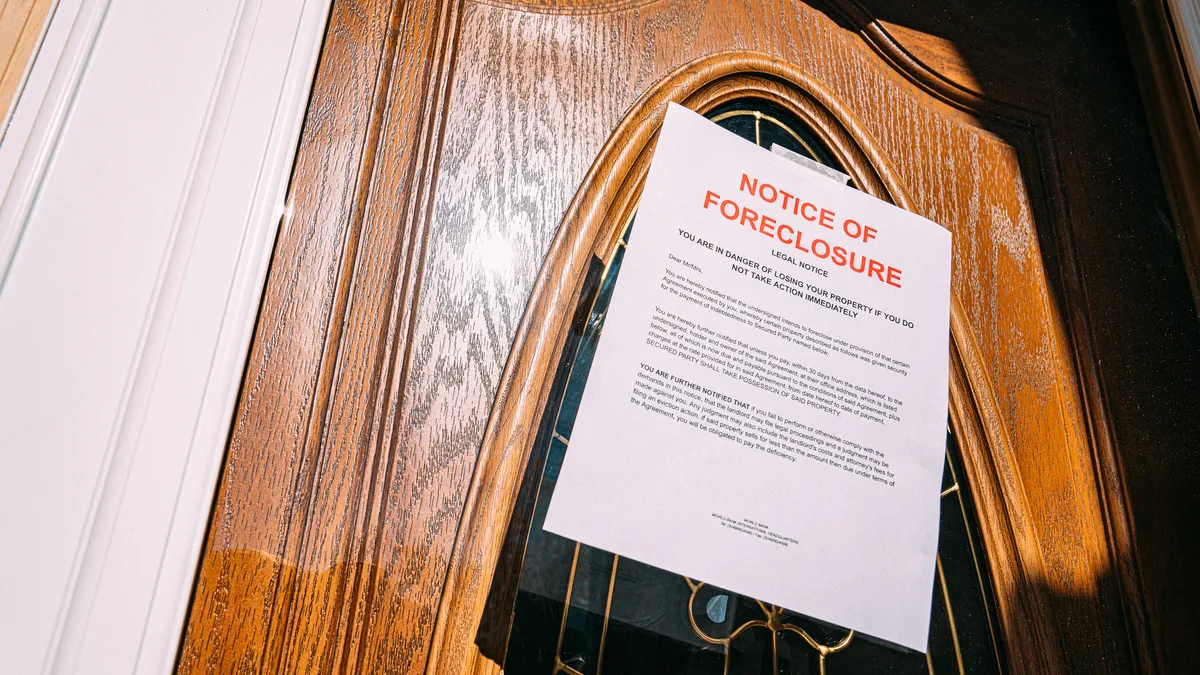

- Multifamily was the only major commercial real estate sector to post increases in delinquency and servicing rates in July, according to a pair of recent reports from data firm Trepp.

- CRE delinquencies rose 10 basis points to 7.23% in July, driven by a 24-bps jump for apartment commercial mortgage-backed securities loans, according to a report from Trepp. The multifamily rate hit 6.15%, up from 2.63% a year ago.

- While the overall CRE special servicing rate decreased 9 bps to 10.48% in July, the multifamily rate jumped 19 bps to 8.37%, according to Trepp. One year ago, it stood at 5.11%.

Dive Insight:

Trepp wasn’t alone in pointing out problems in multifamily loans in July. Apartment and office delinquencies drove a 6-bps increase in CRE delinquencies, according to a report from Fitch Ratings.

While CMBS loans are a problem spot for multifamily, lenders across the debt universe are beginning to take a harder look at the troubled apartment properties on their books in 2025, according to industry sources.

“I think those conversations are being had,” said Kyle Draeger, executive managing director of multifamily debt and structured finance at Dallas-based CBRE Capital Markets. “Maybe you've exercised two or three [loan] extensions, and the debt funds or banks are saying, ‘You've done enough. Let's see if you can sell or refinance at this point.’”

Draeger has also seen a fair amount of borrowers put cash in as they’ve refinanced their loans.

“There's definitely been that capability of the equity markets to fund a little bit more equity to get off of a bridge loan and into a permanent loan,” Draeger said.

Despite this increase in lender activity, Draeger wouldn’t characterize these problem loans as distressed. “I would use the word ‘stress,’” he said. “There are a lot of stressed properties.”

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.