Dive Brief:

- Multifamily saw the second-largest increase in commercial mortgage-backed securities delinquencies among real estate sectors in January, with its rate rising 30 basis points to 6.94% month over month, according to a report from data firm Trepp. Six months ago, it sat at 6.15%, and 12 months ago, it was 4.62%.

- The multifamily CMBS special servicing rate moved 6 bps higher MOM to 8.14% in January, according to a separate report from Trepp. Six months ago, it was 8.37%, and 12 months ago it was 8.42%.

- The overall Trepp CMBS delinquency rate increased 17 bps MOM in January to 7.47%, driven by the office sector jumping 103 basis points from December to an all-time high of 12.34%. The retail rate rose 12 bps MOM to 7.04%, while lodging saw the largest drop, falling 105 bps to 5.56%. Industrial delinquencies declined 18 bps MOM to 0.62%.

Dive Insight:

The Trepp CMBS special servicing rate increased by 20 bps MOM in January to 10.91%, led by the office sector, which rose 47 bps to 17.11%. Industrial inched up 1 bps from December to 0.85%, while retail fell 23 bps to 11.76% and lodging dropped 11 bps to 9.37%.

Trepp isn’t the only data source showing an increase in CRE problem loans. CRED iQ reported a distress rate across all sectors of 11.98% in January 2026, which was a 148% increase over the past 43 months. The firm’s analysis includes all loans classified as CMBS conduit or single asset, single borrower.

“This remarkable expansion reflects the compounding effects of monetary tightening, weakened property fundamentals, and a challenging refinancing environment that has left borrowers with increasingly limited options,” CRED iQ wrote.

CRE distress numbers briefly retreated in 2025 but accelerated again at the start of this year. CRED iQ said that suggests “that underlying market conditions remain hostile to distressed borrowers seeking resolution.”

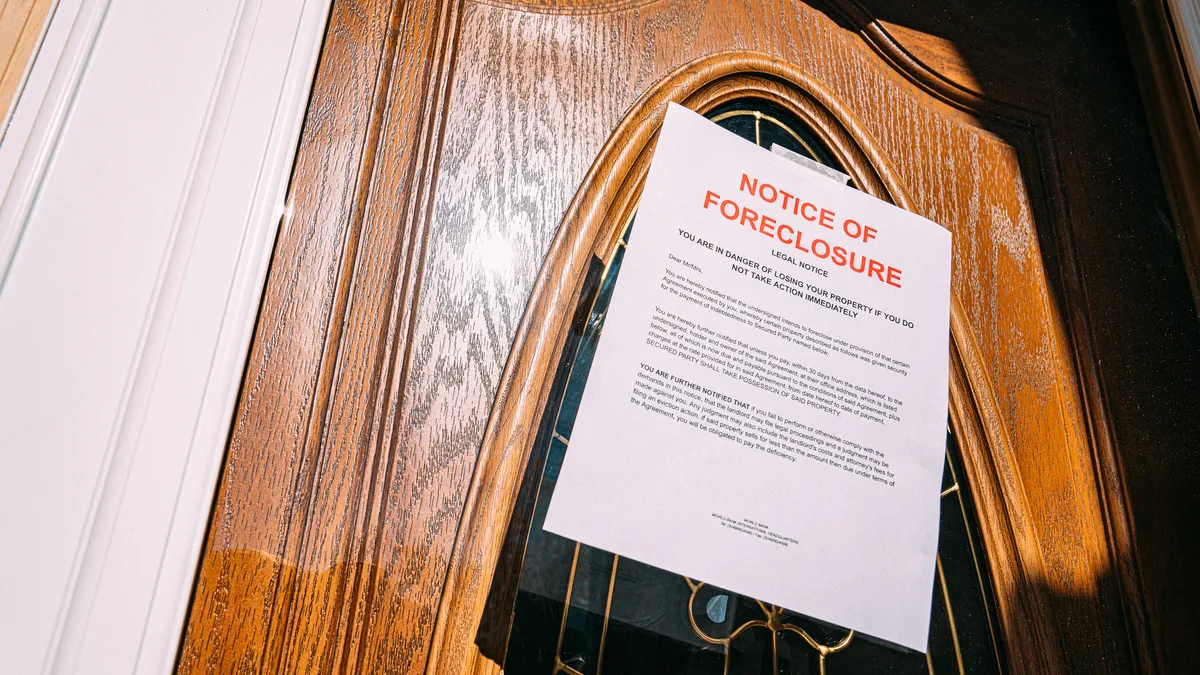

In its report, CRED iQ said servicers were “taking an increasingly aggressive posture toward distressed assets.” Among the $40.1 billion in specially serviced CRE loans with defined workout strategies, the breakdown includes:

- Foreclosure: 39.1%, $15.7 billion

- Note sales: 18.7%, $7.5 billion

- Loan modifications: 20.3%, $8.1 billion

- REO properties: 12.7%, $5.1 billion

“The prevalence of liquidation-focused strategies over collaborative solutions underscores servicers’ belief that many troubled assets cannot be salvaged under current market conditions,” according to CRED iQ.

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.