For years, apartment operators have circled late 2025 and 2026 as a time when new apartment deliveries would begin to slow, allowing them to tamp down on concessions and even increase rents in high-delivery markets.

As expected, new deliveries are falling. At the end of August, 686,000 units were under construction, a 20.2% year-over-year drop, and multifamily developers finished an annualized 503,000 apartments in buildings with five or more units during the month, a 28.7% YOY drop.

“Spring of 2026 is when the bulk of that [supply] is finally in the rear view mirror,” rental housing economist Jay Parsons told Multifamily Dive. “That's what everyone's been gunning for. That's been the light at the end of the tunnel.”

However, even with relief on the delivery front, as the final months of the year approach, the “Survive for ’25” mantra seems to be a distant memory, as economic uncertainty around things like tariffs and jobs has permeated a market still dealing with heavy supply.

For instance, tariffs are expected to pose a heavy drag on the economy and will slow gross domestic product growth to 1.6% this year, the Conference Board said earlier this month, noting that its Leading Economic Index fell more in August than in any month since April.

The jobless rate rose from 4.2% in July to 4.3% in August, as the number of unemployed people sat at 7.4 million according to the U.S. Bureau of Labor Statistics. While the numbers aren’t necessarily increasing, job growth isn’t taking off either.

“We've certainly already seen some disruption and the potential to slow further and get down to essentially no job generation,” said Greg Willett, chief economist at Dallas-based lease insurance provider LeaseLock. “So [people are] hesitant to push rents.”

General uncertainty

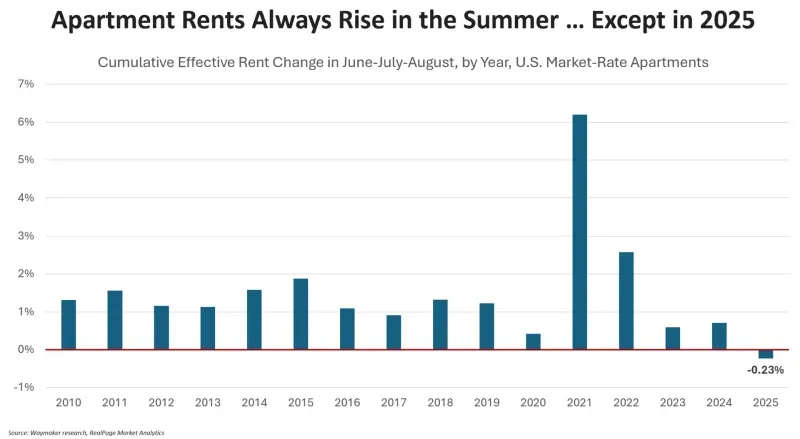

Apartment rents usually rise over the summer. But that wasn’t the case this year, as concessions weighed on price growth. In 2025, rents fell for the first time since the global financial crisis in 2010, according to Parsons. While rents only fell 0.23%, according to RealPage Analytics and Waymaker research, the negative trend created uncertainty.

Other sources showed similar weakening. Apartment List reported the national median rent dropped 0.2% in August to $1,400, as the rental off-season arrived. Additionally, rent prices fell 0.9% through the first eight months of the year compared to the prior-year period.

Willet said he thinks the economy is behind these declines. “What's driving the demand numbers now is what's happening in the economy and how consumers are feeling,” Willet said. “Are they going to readjust their spending patterns at all?”

For some apartment owners, issues began showing up earlier in the year. On AvalonBay Communities’ second-quarter earnings call, Chief Operating Officer Sean Breslin noted that conditions around asking rents had been softer than expected in 2025.

“Primarily, our expectation is tied to slightly weaker job growth in the first half of the year than originally anticipated,” he said. “So when you start to look across the footprint … across the first half of the year, we ended up with about 100,000 fewer jobs than originally projected.”

The jobs picture in certain markets could be especially challenging for the renter-by-choice cohort that occupies higher-end multifamily properties, though Breslin noted that he potentially sees things improving on that end later in 2025.

“The composition does not favor higher-end multifamily right now, given the weaker environment for finance, professional services [and] technology [jobs],” Breslin said on the earnings call.

Other management teams are also seeing cracks. In Southern California, COVID-19-era eviction moratoriums and general economic softness related to the national economic picture muted growth for San Mateo-based REIT Essex Property Trust.

“We’ve all experienced a lot of the noise with public policy and the lack of clarity there. And so I do think companies have been more reticent in hiring and investing, which of course impacts our overall growth,” CEO Angela Kleiman said on the REIT’s Q2 earnings call in late July.

A push to keep residents in place

The August Conference Board Consumer Confidence Index showed feelings about current job availability declining for the eighth consecutive month. The Expectations Index, which measures consumers’ short-term outlook, decreased by 1.2 points to 74.8%. Readings below 80 typically signal a recession is coming.

On Tennessee-based REIT MAA’s Q2 earnings call, CEO Brad Hill noted that consumer confidence readings fell after President Donald Trump announced tariffs on April 2. Apartment managers are reacting to those conditions by focusing on keeping their residents in place.

“All of that plays into, I think, the psychology of the operators in the market, really getting a bit nervous about performance and what performance looks like and really focusing on occupancy,” Hill said.

Camden Property Trust CEO Ric Campo also said the economic picture has made operators wary. The result is that they aren’t pushing new lease rents, as they try to keep current residents in place.

“This uncertainty around everything that's going on in our economy and politically and all that has caused people to be more cautious and go to a more occupancy-led push,” Campo said on the REIT’s Q2 earnings call in August.

However, Hill said on the Q2 call that he believes landlords should be in a position to push rents in 2026. Campo said he also remains optimistic.

“The consumer itself is healthy,” Campo said in August. “We've had 31 months of wage growth and apartment rents have been flat. … It's not a customer issue as much as it's a mindset of the operators trying to protect themselves for the back half of the year [when the rental market traditionally slows].”

A seasonal slowdown?

Even if the economy is starting to chip away at apartment demand, it may take a while for the weakness to really materialize.

The fall and winter months are typically the slowest for the industry as operators back off on rent increases and focus on occupancy — something they’ve already been doing in 2025.

Due to that seasonality, Parsons said he doesn’t really know if apartment executives will have a true read on the market until spring.

“I don't think we're really going to have a stronger pulse on the direction of the market until we get to the start of the leasing season in March and April,” Parsons said. “I think that will give us a better handle on how 2026 is going to play out.”

However, LeaseLock’s Willett said he thinks apartment executives will get a clearer picture of the market before then. He argues that the pandemic changed seasonal patterns in the business, with leasing activity split fairly evenly across quarters.

“In COVID, all that demand got pushed to the back year,” Willett said. “And so we have a different seasonal pattern now, and there actually is a lot of leasing from the fourth quarter of last year where these leases are going to be turning.”

And, right now, he said he doesn’t expect to see those lease rates increasing by much, if they move upward at all.

“The clients I talk to are doubling down on heads on beds,” Willett said. “You are trying to stay as full as you possibly can. And if that means you have to give up a little bit on pricing power, you're absolutely going to go that route.”

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.