Dive Brief:

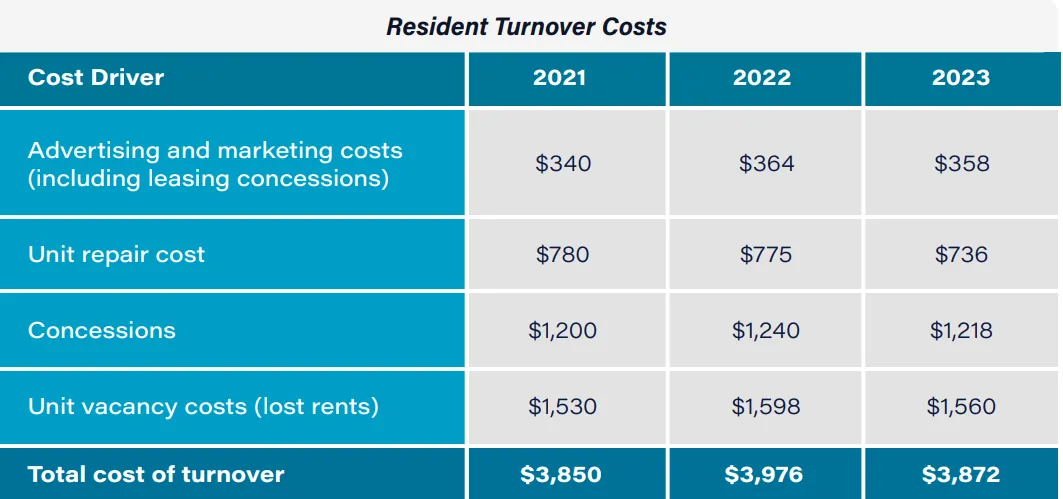

- Apartment turnover costs have held steady this year at about $3,872, according to a new report from San Diego-based property management automation company Zego.

- That number was a slight dip from last year, largely driven by lower rent rates and concessions, the report said. It includes money spent on advertising and marketing, repairs, concessions and the cost of lost rent.

- Even as demand remains strong, multifamily owners and operators are facing pressure to retain their current renters due to an upcoming flood of new inventory. Apartment completions will rise to the highest levels since the 1980s in the second half of 2023 and early 2024, according to the report, which is based on the responses of 630 property managers of communities of 250 units or more.

Dive Insight:

Despite the report’s findings, some companies have noted higher total turnover costs in 2023 as they dealt with larger-than-normal turnover as eviction moratoriums expired in some places. Palo Alto, California-based Essex Property Trust, whose entire portfolio sits on the West Coast, noted “increased turnover driven by eviction-related move-outs,” Essex Senior Vice President of Operations Jessica Anderson said on the REIT’s second quarter earnings call.

“Given ongoing delinquency court backlogs, we will continue to work through evictions for the rest of the year and anticipate some of this activity spilling over into 2024,” Anderson said.

On Houston-based REIT Camden’s second quarter earnings call, chief financial officer Alex Jessett noted that the REIT had twice the amount of early move-outs of non-payers year-to-date as compared to the first half of last year.

When these delinquent payers leave, Camden has incurred higher-than-normal repair and maintenance costs. “Repair and maintenance make up 13% of our total expenses and are now anticipated to increase by 8.5%, a 350-basis-point increase from our prior expectations, resulting from higher unit turnover costs and other miscellaneous repair items,” Jessett said.

Staff turnover matters

Zego’s report also noted higher resident retention rates at properties with low staff turnover. Employee turnover is rapid in the multifamily space. For instance, onsite maintenance technicians had an annual turnover rate of 39.2%, according to the National Apartment Association.

At the same time, renter expectations are rising and residents are demanding more from their apartment living experience, Zego said. Seventy-five percent of managers surveyed said that resident expectations have increased from last year.

The specific areas where residents have higher expectations since last year, according to managers, are:

- Better amenities: 57%

- Better community technology: 51%

- Added concierge services: 49%

- Updated/renovated units: 44%

- Increased flexibility for lease terms or rent payment schedules: 44%

- More pet-friendly communities: 43%

Zego noted that positive interactions are crucial to keeping current residents happy and avoiding turnover. The report said that consumers are willing to spend more money with businesses that have given them good service.

“So even if you are raising rents, if your resident has had a positive experience with your community, they may be more inclined to renew,” the report said.

Senior Reporter Les Shaver contributed to this report.