Dive Brief:

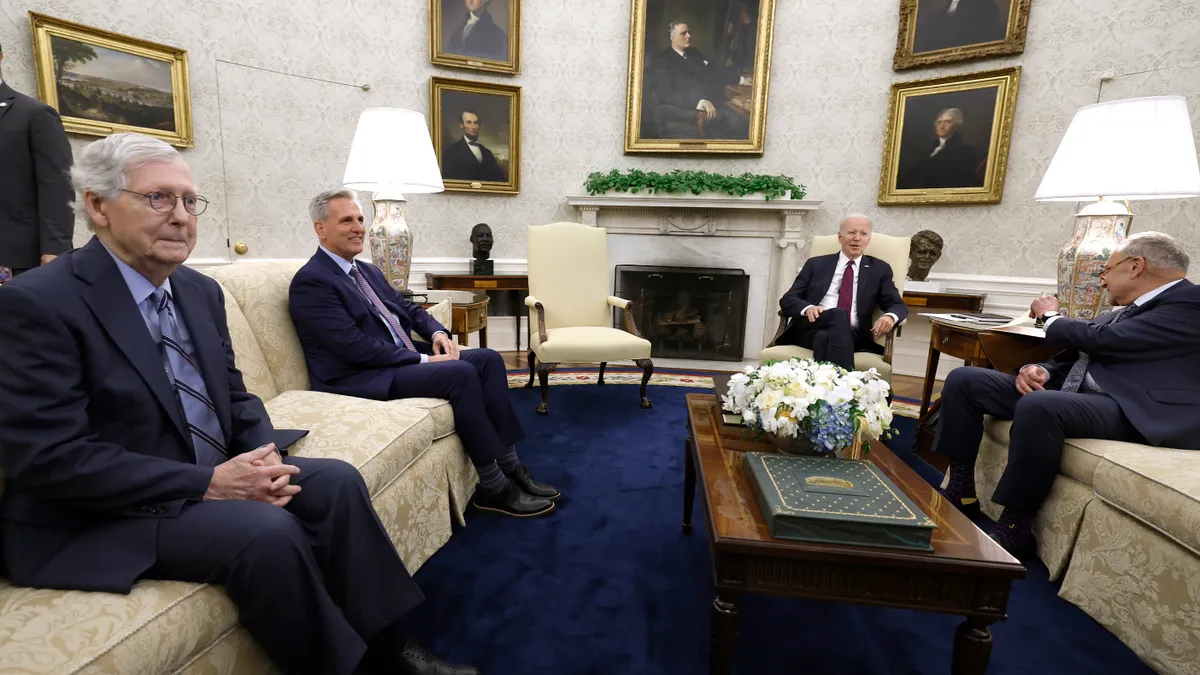

- As President Joe Biden and congressional leaders continue discussions over the U.S. government’s potential debt default, construction and business groups called this week for a quick resolution to the issue.

- Kristen Swearingen, Associated Builders and Contractors’ vice president of legislative and political affairs said that a potential debt crisis must be avoided. “For the sake of all stakeholders who depend upon stable financial markets — including the construction industry — the debt ceiling debate should be resolved immediately in a way that avoids near-term calamity while ensuring financial stability over the long run,” she told Construction Dive.

- Treasury Department officials have said that a default on the $31.4 trillion national debt could come as soon as June 1 and would have a devastating effect on the U.S. economy, according to Reuters, triggering an “economic catastrophe” that would cause interest rates to soar.

Dive Insight:

Before agreeing to raise the debt ceiling, which the government needs in order to continue paying its bills, Republicans want an agreement to cut spending. Meanwhile, Democrats want a "clean increase” on the debt limit before addressing a framework for spending, according to AP News.

The U.S. Chamber of Commerce, the largest business group in the country, backed spending limits and process reform as part of a debt ceiling deal.

“The full faith and credit of the United States government should never be placed at risk, which is why it is essential that Congress and the administration quickly reach a bipartisan agreement to raise the debt ceiling,” Chief Policy Officer Neil Bradley said in a statement on Tuesday.

Several residential real estate groups including the National Multifamily Housing Council and the National Apartment Association implored congressional leaders in March to take action to raise the statutory debt limit to avoid roiling financial markets and other significant sectors of the American economy.

“Given the more than $10.3 trillion in mortgage debt backed by the federal government through Fannie Mae, Freddie Mac, Ginnie Mae and other federal agencies, the housing and real estate markets are particularly susceptible to any instability stemming from concern about the U.S. meeting its financial obligations,” reads the March 29 letter.

Recession proofing

The effect of a default would be devastating to the U.S. economy, including reduced public confidence and increased market volatility, according to a report from J.P. Morgan about the multifamily industry.

“An actual default will throw into question the entire creditworthiness of the United States and likely lead to further [interest] rate increases to justify increased risks that bondholders will now have to consider,” Victor Calanog, head of commercial real estate economics at Moody’s Analytics said in the report. “That will roil capital markets — not just for multifamily and commercial real estate, but every asset class.”

In light of the potential economic calamity, it’s important for owners and developers to try to recession-proof their properties as much as possible, the report said. But rising interest rates are already squeezing owners and lenders, making it difficult to set aside money or refinance existing debt, it noted.

Looking ahead

As both parties continue to haggle over the specifics this week, business and construction leaders must wait to see how the issue will play out and what impact it will have on their companies.

Nevertheless, Ginger Chambless, head of research for commercial banking at JPMorgan Chase, said the U.S is unlikely to default on its debt and that past showdowns have been resolved.

“While we have a highly polarized Congress negotiating, it isn’t in either party’s interest to let a default happen,” she said in the report.